One would think that with all the controversy about when our world oil supply is likely to peak and begin declining, we would make it a priority to ascertain the amount of reserves and begin calculating with certainty how long we can continue to enjoy this most treasured resource. Unfortunately, we’re not doing that. Each oil-producing nation reports its own reserves, and many of them hide their remaining reserves behind a thick wall of secrecy.

Everyone agrees on three basic facts: (a) we humans are now consuming oil at the rate of about 85 million barrels of oil per day, or about 31 billion barrels per year; (b) world demand for oil continues to increase, driven mostly by the fast-growing economies of the developing world, notably India and China; and (c) the world has used to date approximately 1 trillion barrels of oil. There is wide disagreement on the size of the remaining reserves and how easy or practical it will be to extract them.

The Optimists

The US Geological Survey estimates that the total world conventional oil supply is about 3.0 trillion barrels, of which we have used 710 billion.

| USGS Calculation of Oil Reserves | |||||

| (billions of barrels of oil) | |||||

| U.S. | Non U.S. | Total | |||

| Undiscovered conventional | 83 | 649 | 732 | ||

| Reserve growth (conventional) | 76 | 612 | 688 | ||

| Remaining reserves | 32 | 859 | 891 | ||

| Cumulative production | 171 | 539 | 710 | ||

| Total | 362 | 2,659 | 3,021 | ||

Note that fully 688 billion barrels is in expected growth in reserves, and another 732 billion barrels is in oil to be discovered later. The USGS says that expected growth in reserves comes from four sources:

- As drilling and production within discovered fields progresses, new pools or reservoirs are found that were not previously known.

- Advances in exploration technology make it possible to identify new targets within existing fields.

- Advances in drilling technology make it possible to recover oil and gas not previously considered recoverable in the initial reserve estimates.

- Enhanced oil recovery techniques increase the recovery factor for oil and thereby increase the reserves within existing fields.

The state-owned Saudi Aramco is even more aggressive, pegging reserves at 5.7 trillion barrels and predicting that oil extraction won’t peak for another 100 years. Typically, there’s no scientific rationale stated for this prediction, just a bald unsupported statement.

The Pessimists

Compare these relatively cheerful analyses with the findings of Dr. Colin Campbell, a former oil company geologist who has spent the last few years publishing a decidedly downbeat interpretation of oil reserves. In his 1998 article in Scientific American, co-authored with Jean H. Laherrère, Campbell pegs world oil usage to date at about 1 trillion barrels and remaining reserves at only 1 trillion barrels. If Campbell is right, therefore, the world’s oil supply has peaked already or is in the process of peaking.

Or consider Matt Simmons, an oil investment banker turned self-taught geologist, who believes it likely that the world’s oil extraction rate peaked in early 2006.

The Middle Ground

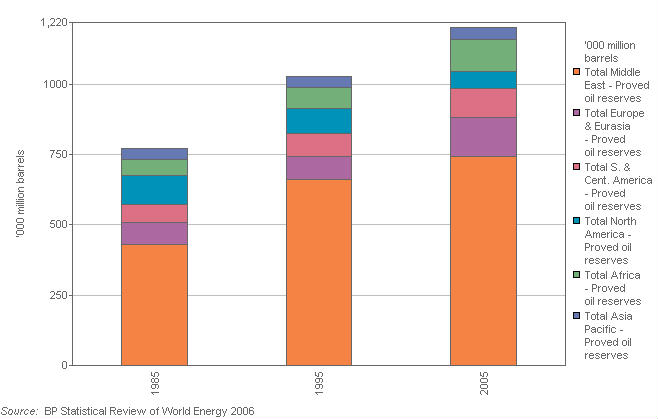

BP Oil says the total petroleum reserves stand today at about 1,220 million barrels. Here’s their breakdown:

Note how the reserves have increased over time, and note in particular the huge increase in reserves labeled “Total Middle East” between 1985 and 1995. More about that below.

Note how the reserves have increased over time, and note in particular the huge increase in reserves labeled “Total Middle East” between 1985 and 1995. More about that below.

If we assume (as BP does) that total consumption to date is a tad over 1 trillion barrels, that means a total of 2.2 trillion barrels of oil in the world supply. This in turn means that world oil peak will arrive when we have consumed 1.1 trillion barrels (an additional 100 billion barrels), or in about three years. BP wouldn’t agree with this last statement, however, because they predict the world oil supply will continue to increase.

Chevron has an eye-opening counter on their Will You Join Us site showing how fast we’re consuming oil now. You need to take a look.

Reconciling the Differences

How could these estimates start with the same publicly available data and diverge so dramatically? Let’s look at what they have in common and where they differ.

There’s wide consensus that cumulative world oil extraction stands at about 1 trillion barrels. There’s wide consensus that the world’s demand for oil is continuing to grow, fueled not only by the energy appetites of North America and western Europe but more importantly by the mushrooming economies in China and India. The difference in the estimates lies in two primary areas:

- The confidence placed by the optimists (and the lack of confidence placed by the pessimists) in the reported reserves of secretive oil-producing nations

- The confidence placed by the optimists (and the lack of confidence placed by the pessimists) in the continued growth of existing reserves, the continued discovery of large new sources of conventional oil, and the feasibility of developing sources of unconventional oil (primarily oil shale and tar sands).

Can We Trust Reported Reserves?

There are several reasons to assume that the oil reserves published by nations (and relied on by the US Geological Survey and others in the optimist camp) are systematically and significantly overstated:

- Most of the key producing nations treat their existing oil reserves as a state secret and work to limit the flow of information about them to the outside world.

- The more reserves a nation reports, the more prestige it enjoys in the world. And if that nation is in OPEC, larger reserves translated to a larger quota for how much oil that nation could pump.

- During a period of seven years, from 1983 to 1990, seven OPEC countries increased their reported reserves suddenly and substantially, at a time that corresponded with no significant new discoveries and no significant development of new processes. Iraq increased its reserves by 38% in 1983; then Kuwait increased reserves by 41% in 1985; then in 1988, Abu Dabhi, Dubai, Iran, and Venezuela increased their reported reserves by 125 to 197%. Not to be outdone, Iraq increased its reserves that year by anadditional 112%. Finally, in 1990, Saudi Arabia had had enough and increased its reserves by 58%. These suspicious increases total about 300 billion barrels of oil. Since these increases, the OPEC countries have reported no cuts in reserves and some increases, even though they are constantly drawing oil out of their fields. You can see the actual reported reserve figures on Wikipedia.

Our answer to this question (Can we trust reported reserves) is no, although we realize others see it differently. We like the way Colin Campbell expresses it: “Estimating oil reserves is a scientific process; reporting oil reserves is a political act.”

Can We Trust Continued Growth of Existing Reserves?

Estimating oil reserves is a science, but it’s an inexact science. The US Securities and Exchange Commission promulgated regulations in the early days of oil extraction that encouraged companies to state their reserves conservatively and then to increase them only when they could be confident about them. And it worked well for the companies, because it gave them a steady stream of good news they could share with their stockholders. Most of those upgrades to reserves have already worked their way through the system now, though. So it’s not at all clear that present stated reserves are likely to be increased from their totals today. In particular, it seems foolish to assume that the reserves of the secretive OPEC countries will continue to increase when it seems obvious that they are already inflated.

How Likely Is It We’ll Discover New Sources of Conventional Oil?

Global oil discovery peaked in the 1960s. Since the mid-1980s, we humans have been consuming more oil than we’ve been discovering. And this at a time when the price of oil has roughly tripled, so there’s ample financial incentive to go out and find new oil. Sure, there will be discoveries of new oil, but they are likely to be small deposits in remote and inhospitable climates, nothing like the 600 billion barrels the optimists keep claiming. Sorry, it just won’t happen.

But What About Unconventional Oil?

Initially, the statistics of unconventional oil are eye-popping. For example, it sounds like great news that the known reserves of oil shale have petroleum in them that can be converted to 2.6 trillion barrels of oil (that’s right, equal to or greater than the original total world supply of conventional oil). And tar sands? Something like 3.6 trillion barrels of synthetic oil.

There are two big problems with pulling oil from these sources, though. The first is that pesky ERoEI formula. If it takes the energy of a barrel of oil to get a barrel of oil, the process is futile. If it takes the energy of more than a barrel of oil, the process is insane. The second big problem is that the only way we know to get at oil shale and tar sands is by strip mining for them, ripping up huge tracts of land and rendering that land virtually unusable for succeeding generations.